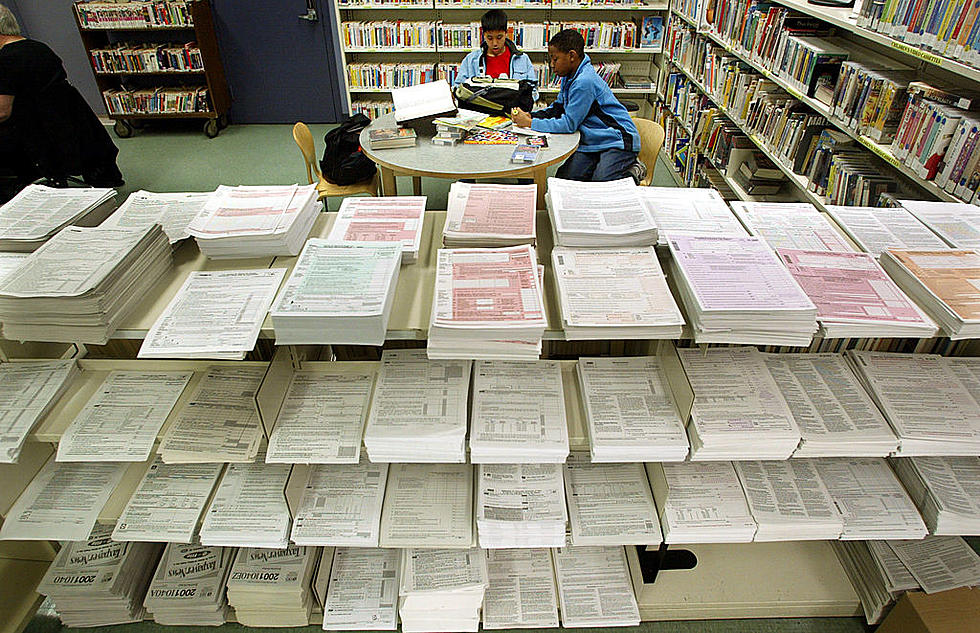

Today Is Tax Day, Harsh Penalties If You Miss The Deadline

Congress has dreamed up lots of penalties to punish tax scofflaws, including:

The 5% Per Month Failure-to-File Penalty, the 20% Intentional Disregard Penalty, and others.

Smart Money's Bill Bischoff tells us why we don't want to miss today's tax deadline.

If you can't pay by the April 18 deadline, you can usually arrange with the IRS to pay the shortfall in installments over as many as 60 months. You'll be charged interest on the unpaid balance, but the current monthly rate is only .583% (the rate can change each quarter). Alternatively, you could put your tax bill on a credit card if you think that's a better deal.

More From The New 96.1 WTSS